maryland earned income tax credit 2019

This amount should be entered on Line 1 of the Income Tax Credit Summary section of the Form 502CR. Allowable Maryland credit is up to one-half of the federal credit.

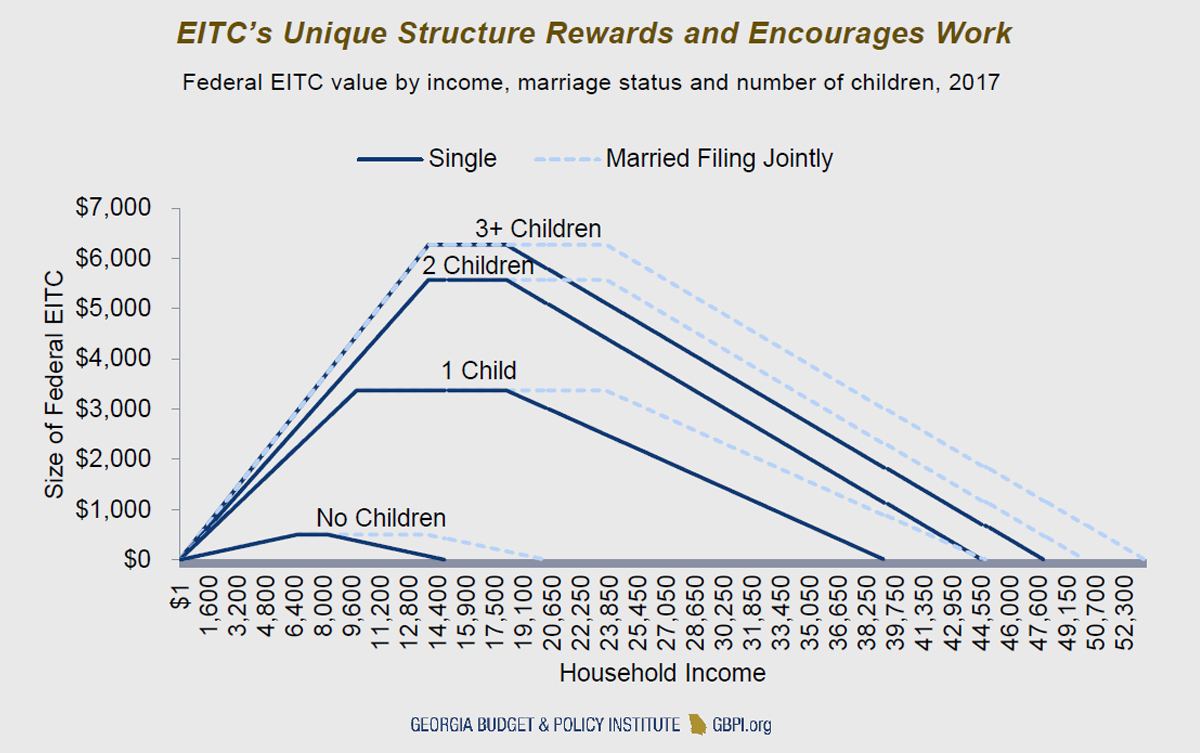

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

You must file your Maryland income tax return on Form 504 and complete through the line for credit for fiduciary income tax paid to another state on the Form 504.

. See Instruction 21 for more information. Get Your Max Refund Today. This bill passed by the Maryland General Assembly establishes an individual or business may claim a credit against their Maryland State income tax equal to.

The Maryland earned income tax credit EITC will either reduce or. Employees without a qualifying child may qualify for the full amount of the federal credit up to 530. 20 2 A resident may claim a credit against the county income tax for a.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. Reduces the amount of Maryland tax you owe. Some taxpayers may even qualify for a refundable Maryland EITC.

50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. This is a result of House Bill 856 Acts of 2018 amending the Maryland earned income tax credit to allow an individual without a qualifying child to.

However the payments might be subject to federal income tax. 50162 55952 married filing jointly with three or more qualifying children 46703 52493 married filing jointly with two qualifying children. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following.

Line 13 of the Form 502LC is your State tax credit. Individuals who received the Maryland earned income tax credit EITC in tax year 2019. There is one modified refundable tax credit available.

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. 21 2 A resident may claim a credit against the county income tax for a. House Bill 482 Acts of 2019.

Your employees may be entitled to claim an EITC on their 2019 federal and Maryland resident income tax. Married employees or employees with qualifying children may qualify for up to half of the federal earned income credit. Beginning January 1 2016 law enforcement officers can claim an income tax subtraction modification for the first 5000 of income earned if.

20 2 A resident may claim a credit against the county income tax for a. Check this box if you are claiming the Maryland Earned Income Credit but do not qualify for the federal Earned Income Credit. To be eligible for the federal.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of Maryland. 18 a 1 A resident may claim a credit against the State income tax for a taxable 19 year in the amount determined under subsection b of this section for earned income. Taxpayers to indicate they are claiming the Maryland Earned Income Credit but do not qualify for the federal Earned Income Credit.

To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than the following. Earned Income and Child Tax Credits Outreach Act of 2020. 2019 estimated tax payments amount applied from 2018 return payment made.

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit. Employees who are eligible for the federal credit are eligible for the Maryland credit. 1 The law enforcement officer resides and works in the same political subdivision.

Most taxpayers who are eligible and file for a federal EITC can receive the Maryland state and local EITC. 2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the federal and Maryland EITC. Your employees may be entitled to claim an EITC on their 2019 federal and Maryland resident income tax.

The local EITC reduces the amount of county tax you owe. With the exception of some members of the military these payments are limited to current Maryland residents1 These payments will not be subject to Maryland tax. Allowable Maryland credit is up to one-half of the federal credit.

2019 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide electronic or written notice to an employee who may be eligible for the federal and Maryland EITC. The allowable Maryland credit is up to one-half of the federal credit. 19 a 1 A resident may claim a credit against the State income tax for a taxable 20 year in the amount determined under subsection b of this section for earned income.

18 a 1 A resident may claim a credit against the State income tax for a taxable 19 year in the amount determined under subsection b of this section for earned income. Actions on HR7551 - 116th Congress 2019-2020. BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit.

2 The crime rate in the political subdivision exceeds the States crime rate. Then complete Form 502LC.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Form 1040 Earned Income Credit Child Tax Credit Youtube

Eic Frequently Asked Questions Eic

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Rules For The Maryland State Income Tax Subtraction Modification For 2020 Maryland State Firemen S Association

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Table 1 From The Earned Income Tax Credit Eitc Percentage Of Total Tax Returns And Credit Amount By State Semantic Scholar

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Filing Maryland State Taxes Things To Know Credit Karma Tax

Personal Income Tax Brackets Ontario 2020 Md Tax

Maryland Relief Act What You Need To Know Mvls

How Does The Deduction For State And Local Taxes Work Tax Policy Center