dependent care fsa limit 2022

125i IRS Revenue Procedure 2020-45. Please note you may not double-dip expenses eg expenses reimbursed under your Dependent Care FSA may not be reimbursed under your.

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

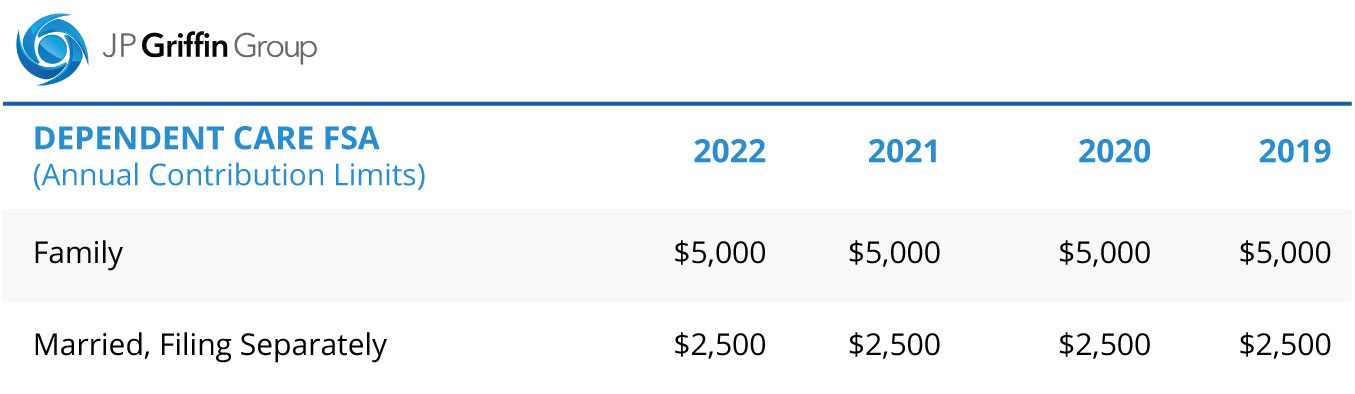

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022.

. The new DC-FSA annual limits for pretax contributions increases to 10500 up from 5000 for single taxpayers and married. For 2022 the exclusion for DC FSA benefits under Code Sec. Unlike the health care FSA which is indexed to cost-of-living adjustments the dependent care FSA maximum is set by statute.

The minimum annual election for each FSA remains unchanged at 100. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing separately. Dependent Care FSA Limits Stay Flat For 2022.

You may enroll in an FSA for 2022 during the current Benefits Open Season which runs through December 13 2021 midnight EST. The guidance also illustrates the interaction of this standard with the one-year increase in the. Therefore absent additional congressional action the dependent care fsa limit will revert to 5000 for the 2022 calendar year.

The employee incurs 7000 in dependent care expenses during the period from January 1 2022 through June 30 2022 and is reimbursed 7000 by the DC FSA. The limiting age remains at 14 for the 2021 plan year but this relief only applies to dependent care fsa funds. Contributions are now capped at 5000 annually for head of household or married filing jointly.

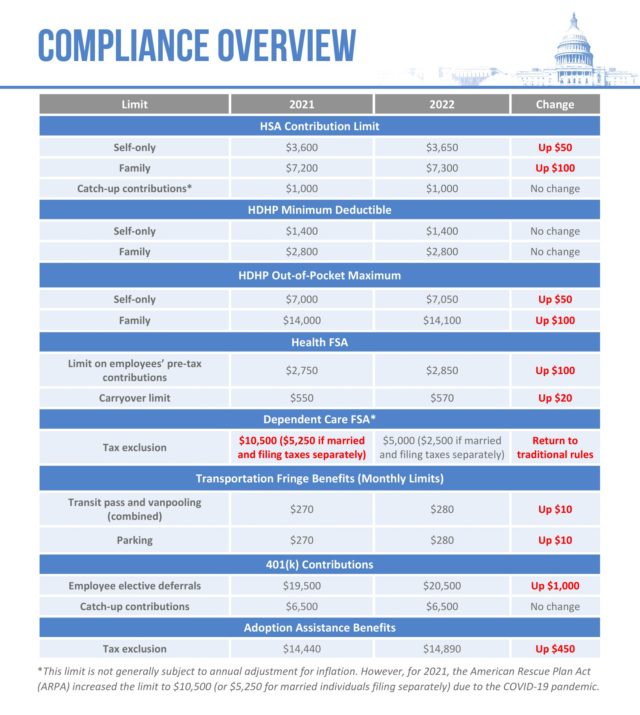

It remains at 5000 per household or 2500 if married filing separately. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could contribute 5250 up from 2500. It also increases the value of the dependent care tax credit for 2021.

Employers can choose whether to adopt the increase or not. 5000 per household for the 2021-22 plan year. IRS annual contribution limit for 2022.

Employers can offer employees participating in health flexible spending accounts FSAs and dependent care FSAs greater flexibility for rolling over unused funds through 2022 under new IRS guidance. Extend grace periods to 12 months for plan years ending in. Also employees not able to use all of their DCAP funds by the end of 2021 can still use the extended carryover or grace period into 2022.

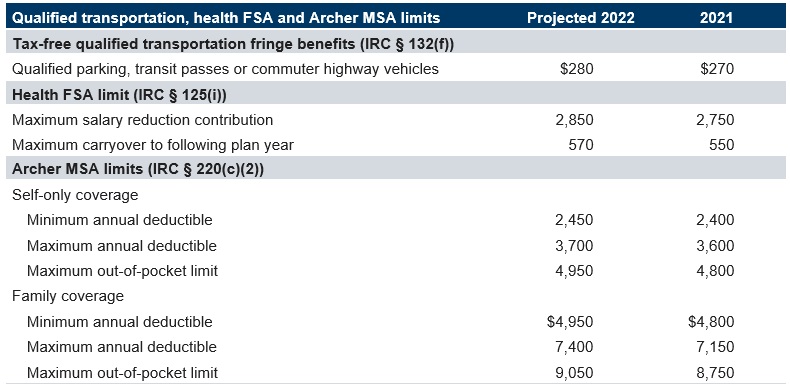

For 2022 the DC-FSA maximum which is set by statute and is not subject to inflation-related adjustments returns to 5000 a year for single taxpayers and married couples filing jointly or 2500 for married people filing separately. July 1 2021 June 30 2022 IRS contribution limit. While there is an annual limit for employee Health FSA contributions 2850 in 2022 an employer may limit its employees to less than 2850.

View 2022 Health FSA Contribution Cap Rises to 2850 and IRS Clarifies Relief for FSA Carryovers. Employees who are new to the DCAP benefit account in 2022 need to recognize that the annual limit has reverted back to its prior level. Back to main content If you and your spouse are both eligible to contribute to a Dependent Care FSA through your respective employers you and your spouse may not each claim 500000.

Dependent Care FSA Limits Dependent Care FSAs DC-FSAs also called Dependent Care Assistance. For 2022 the dependent-care FSA limit returns to 5000 for single filers and couples filing jointly and 2500 for married couples filing separately. WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable.

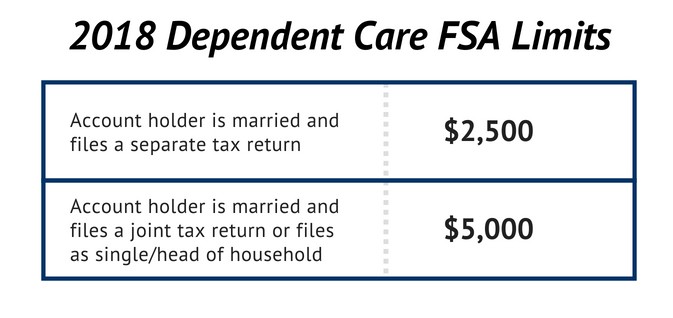

Generally speaking the dependent care FSA contribution limit is 5000 for single and joint filers and 2500 for married individuals. However COVID-19 relief legislation permitted carryover of unused DCFSA balances into the. Tax year 2022.

Dependent Care Flexible Spending Accounts Dependent Care FSAs The maximum contribution is 5000 for the calendar year or 2500 if married filing taxes separately. You must incur qualifying expenses Qualifying Dependent Care Expenses The expenses incurred by dependent care flexible spending accounts as provided in accordance with IRS Code Section 129. For 2022 it remains 5000 a year for individuals or married couples filing jointly or 2500 for a married person filing separately.

What is the 2022 dependent care FSA limit. Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. The 10500 contribution limit or 5250 if married filing taxes separately for the 2021 calendar year was a one-year temporary provision that was included in the.

That means for a married couple each parent can contribute 2500 to their own Dependent Care FSA for a total of 5000.

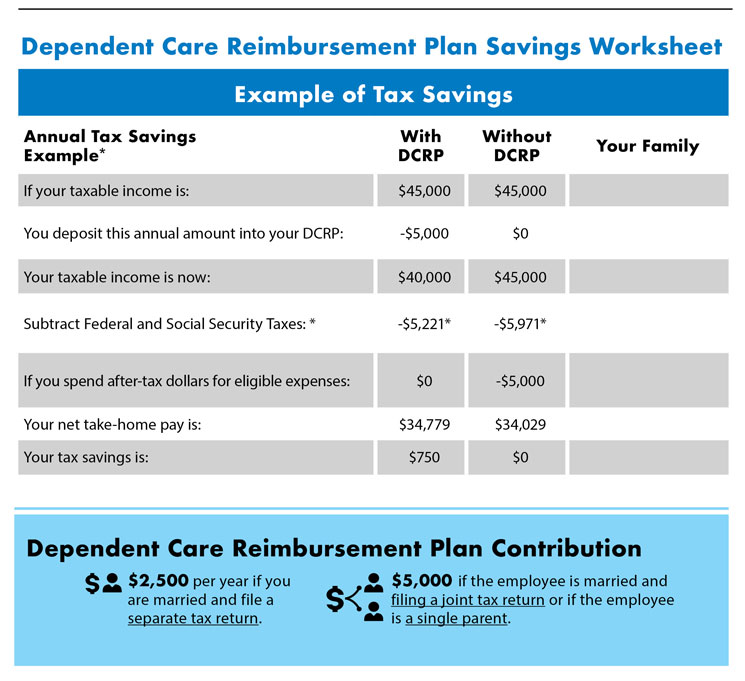

Coh Dependent Care Reimbursement Plan

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Irs Announces Health Fsa Limits For 2022 M3 Insurance

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

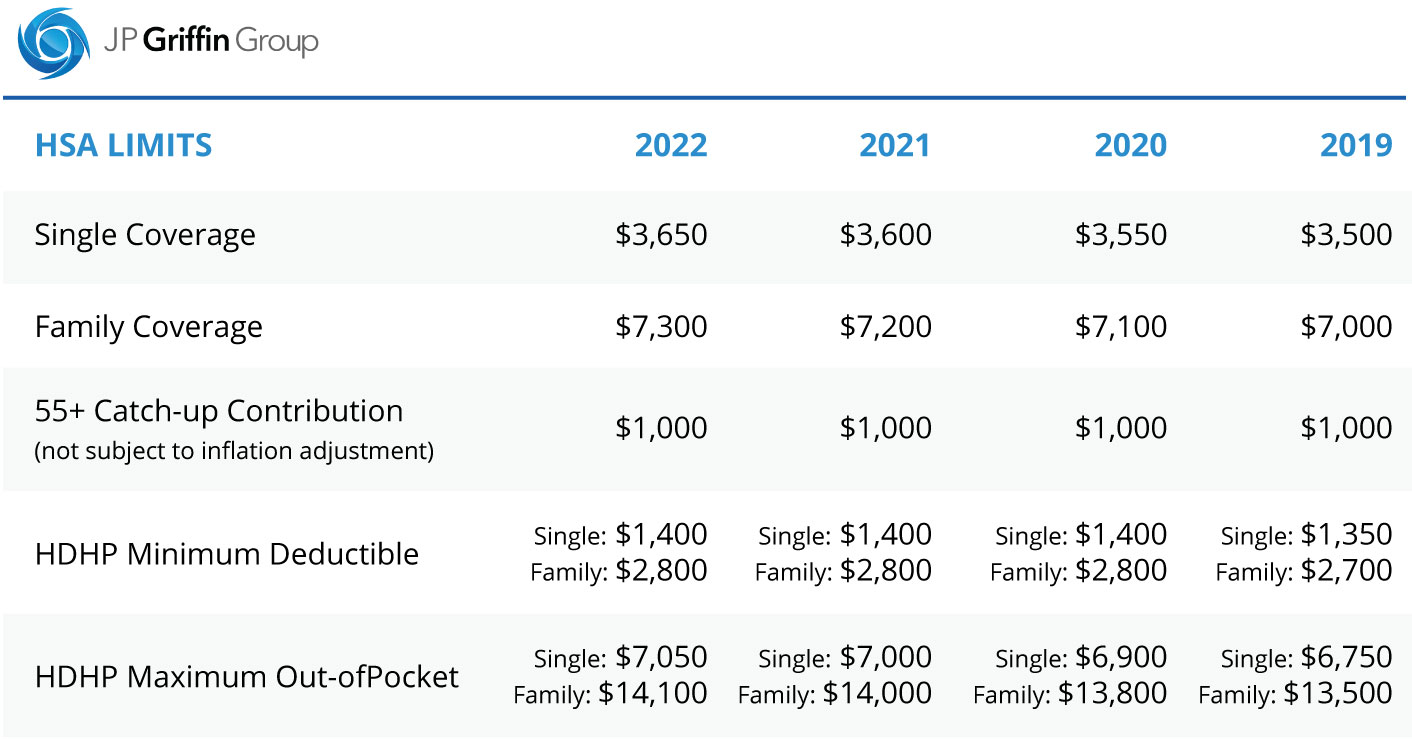

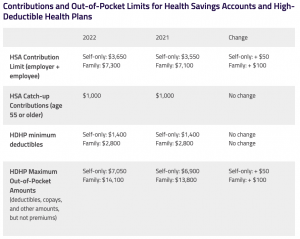

What The New 2022 Hsa Limits Mean For You The Difference Card

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Open Enrollment For 2022 Begins Attend The Benefits And Wellbeing Fair

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

What Is A Dependent Care Fsa Wex Inc

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

As Inflation Soars Irs Announces Annual Inflation Adjustments For 2022 Lexology

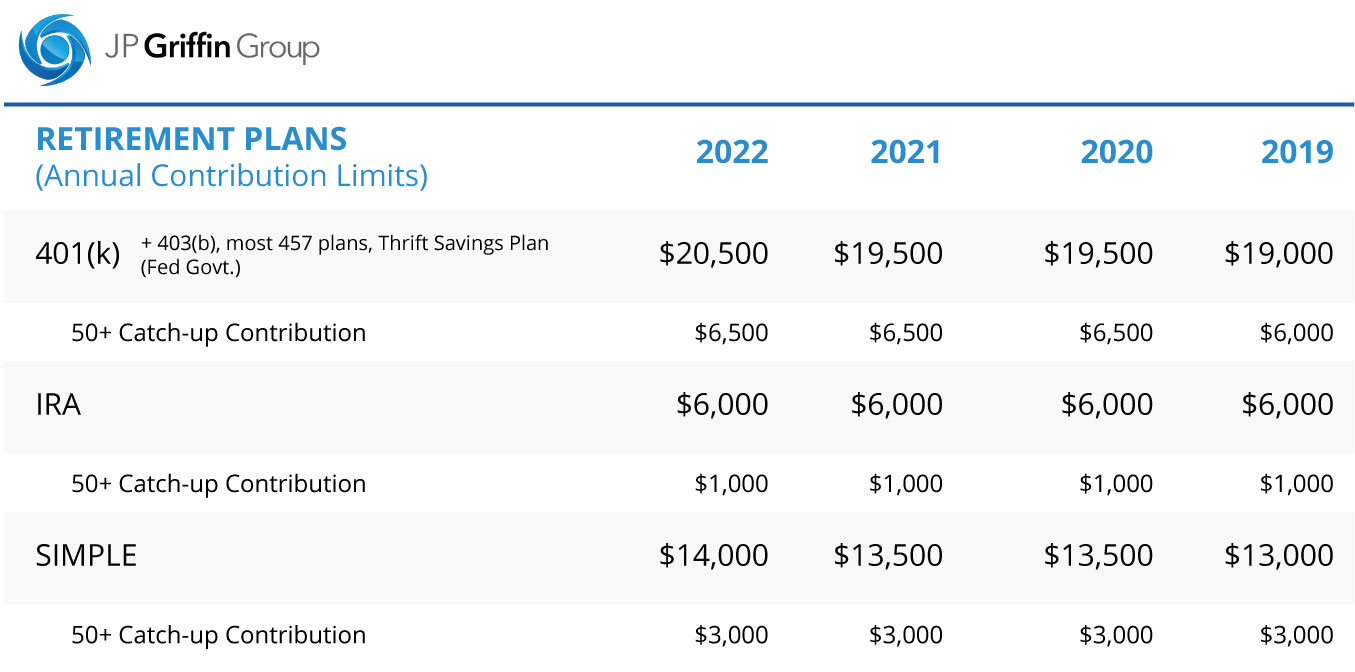

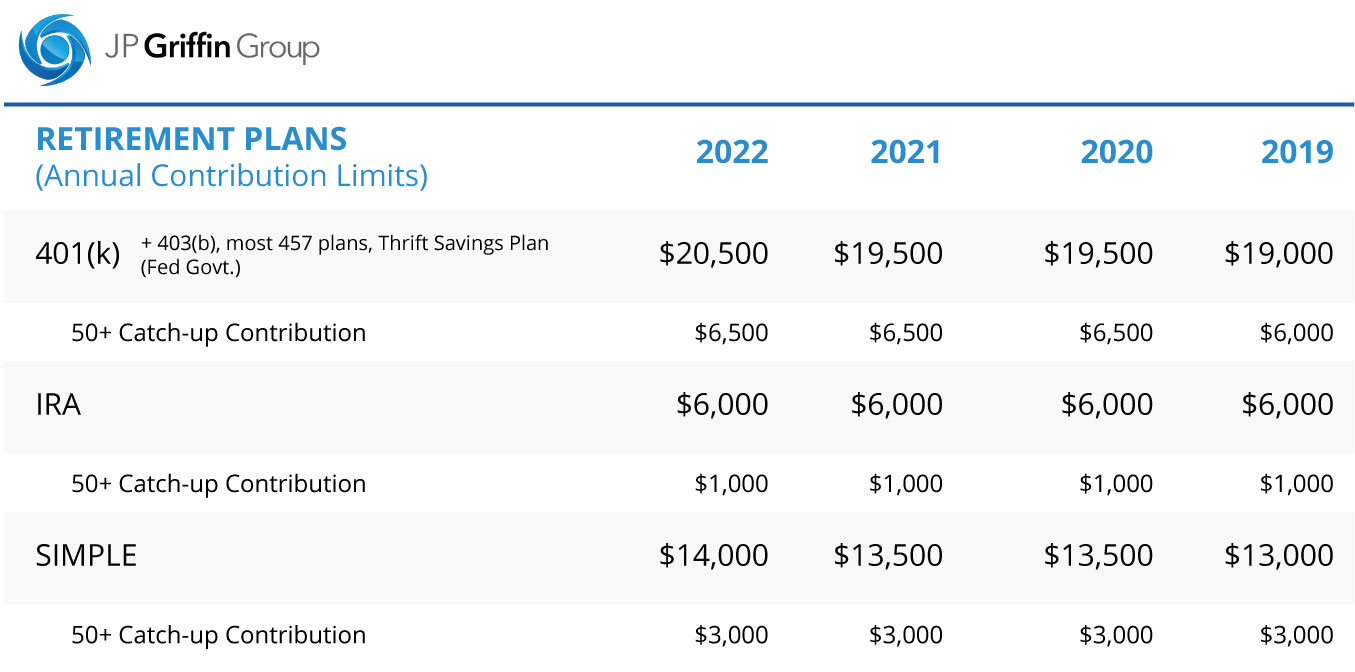

Employee Benefit Plan Limits For 2022

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Using A Dependent Care Fsa To Reimburse Childcare Costs In 2022

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning